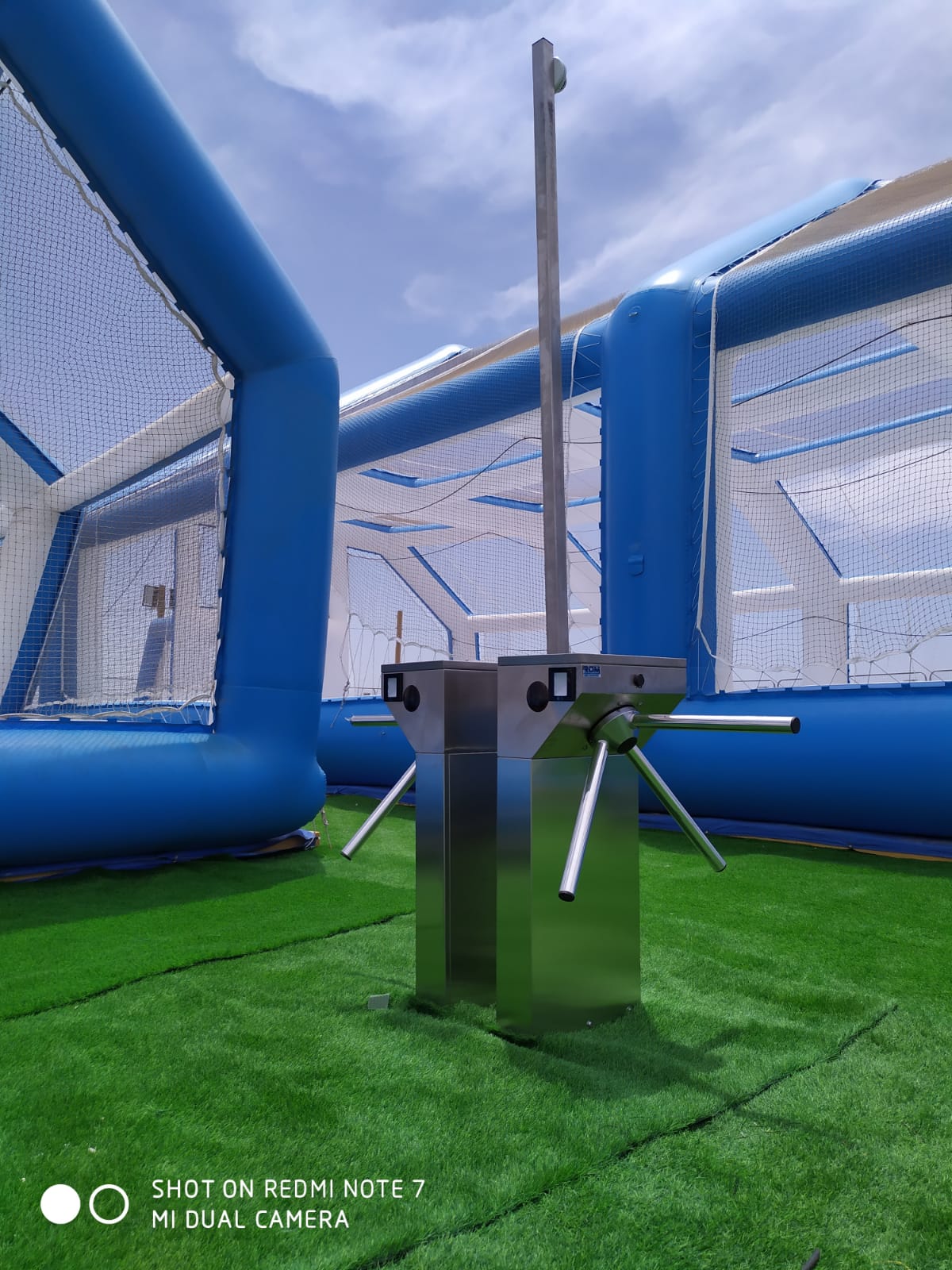

מגוון רחב של פתרונות בקרת כניסה

בקרת כניסה לדלת ומערכת כניסה ממוחשבת, אלה הם הכלים הפרקטיים והטובים ביותר שיספקו לעסק שלכם את ההגנה הטובה ביותר. חברת רום טכנולוגיות מעמידה לרשותכם צוות מקצועי ושפע של כלים כדי שתוכלו לתכנן את הצעדים הבאים שלכם, להגדיר את צרכי העסק והאבטחה בצורה הטובה ביותר, ולקבוע מי רשאי להגיע לכל פינה במתחם.